Tap into My Equity(https://tapintomyequity.ca/) is a company that I would highly recommend freelancers avoid at all costs. My experience with this company has been incredibly negative, and I feel compelled to share my story to warn others. I completed a project for Tap into My Equity, and despite several attempts to contact the company for payment, I have yet to receive any compensation for my services. The lack of professionalism and disregard for timely payment has left me feeling undervalued and disrespected as a freelancer.

The desire of homeownership generally arrives bundled Together with the idea of setting up equity. It is really that sense of accumulating prosperity within your own walls, a escalating nest egg represented through the soaring value of your house. But Imagine if you can unlock that probable, flip that equity into usable cash? Which is where the idea of tapping into your property fairness is available in.

There are a multitude of explanations why a homeowner may possibly take into consideration this option. Perhaps an surprising price has reared its head, a clinical Monthly bill or simply a critical house fix that throws a wrench into your fiscal strategies. Most likely you have been eyeing a aspiration renovation, one particular that can insert important price to your property even though strengthening your quality of life. Or maybe personal debt consolidation is definitely the target, streamlining many substantial-curiosity debts into a single, extra manageable mortgage.

Whatever the purpose, understanding ways to faucet into your house fairness is critical. The good news is, there are actually proven monetary applications at your disposal, Just about every with its very own pros and things to consider. Let's delve into the most typical options:

**The Home Fairness Mortgage:** Normally known as a next mortgage loan, a house fairness mortgage means that you can borrow a fixed sum of money based upon the appraised value of your property and the level of equity you have crafted up. This equity is typically the difference between your own home's current industry price and what you continue to owe on your existing mortgage loan. The moment approved, you receive a lump sum payment which you then repay in excess of a established expression, ordinarily between five and 30 years, with a fixed interest rate.

This option could be a excellent suit for individuals who need to have a clear, defined amount of money upfront for a selected intent. The preset desire rate gives predictability with your regular monthly payments, and because it is a different financial loan out of your mortgage loan, it does not impact your present home finance loan phrases (assuming you secured a favorable amount originally). Nonetheless, it's important to take into account that you happen to be including A further credit card debt obligation on top of your current mortgage loan, so careful budgeting is vital.

**The Home Equity Line of Credit history (HELOC):** This feature Tap into My Equity capabilities a lot more similar to a credit card secured by your own home equity. After approved, you are specified a credit score Restrict that you can accessibility on an as-desired basis. Think about a revolving line of credit history, where you only pay out fascination on the quantity you borrow. This flexibility could be interesting, especially for ongoing tasks or unpredicted expenses.

There is typically a attract interval with a HELOC, a set timeframe where you can access the funds freely, with minimal payments generally centered on fascination only. Following that draw period of time ends, you enter a repayment time period the place your least payments will raise to incorporate principal combined with the fascination. The variable fascination fee on the HELOC can be quite a double-edged sword. Even though it would be reduced than a fixed-price mortgage initially, it could fluctuate as time passes, potentially impacting your monthly payments.

**The Hard cash-Out Refinance:** This selection includes refinancing your existing home loan for the next total than That which you at present owe. You pocket the difference as hard cash, fundamentally using your built-up equity. For instance your private home's price has increased noticeably, and you've got compensated down a substantial percentage of your authentic property finance loan. A funds-out refinance enables you to faucet into that increased price and utilize the funds for several functions.

The benefit of a cash-out refinance is which you could likely secure a decrease desire charge than your current property finance loan, especially if curiosity premiums have dropped because you initial acquired your private home. This can result in important price savings more than the long term. Nonetheless, it is important to bear in mind you might be extending the repayment time period on your home loan, probably including several years on your financial loan. Also, some lenders have limits on exactly how much hard cash you normally takes out via a dollars-out refinance.

Tapping into your own home equity could be a powerful financial Software, but it isn't really a choice to get taken frivolously. Prior to embarking on this route, thoroughly take into account your motives for needing the funds. Can it be a needed expense, a strategic expense, or A short lived Remedy? Keep in mind, you might be putting your private home on the line, so liable use on the borrowed funds is paramount.

Consulting that has a economic advisor can be priceless. They can help you assess your financial predicament, analyze the several options readily available, and manual you toward the most fitted method for tapping into your private home equity. Don't forget, a well-informed final decision can unlock the potential in your partitions and empower you to achieve your economic aims.

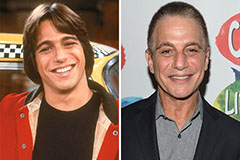

Tony Danza Then & Now!

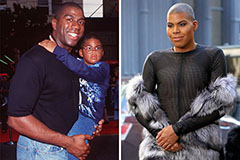

Tony Danza Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!